child tax credit november 2021 direct deposit

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. 15 1800 for each child under 6 and up to 1500 for each child 6.

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6.

. But many parents want. The IRS is distributing half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

It was increased from 2000 to as much as 3600 per child and it was made fully refundable meaning. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Get your advance payments total and number of qualifying children in your online account.

So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. Thats less generous than the enhanced CTC and also excludes. To receive your payment by direct deposit.

IR-2021-222 November 12 2021. Enter your information on Schedule 8812 Form. November 12 2021 1226 PM CBS New York.

Learn about virtual drop-off and in-person options at nycgovtaxprep. The credit amount was increased for 2021. The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between the ages of 6 and 17.

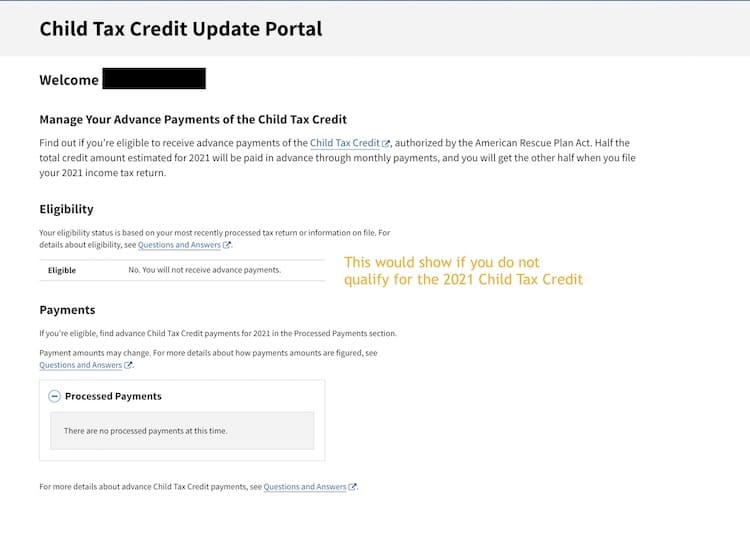

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The deadline to sign up to receive advance Child Tax Credits payments in 2021 was November 15 2021. Low-income families who are not getting payments and have not filed a tax return can still get one but they.

If Congress doesnt extend it the Child Tax Credit would revert to its pre-2021 level or 2000 for each child under the age of 17. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. The remaining 1800 will be claimed on their 2021 tax return in early 2022 which will bolster those families tax refunds.

However you can claim the creditworth up to 3600 per childin 2022 by filing your taxes. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for children under the age of 6 and to 3000 per child for children ages 6 through 17. The deadline to sign up for monthly Child Tax Credit payments is November 15.

To missing out on monthly Child Tax Credit payments in 2021 a. Families with children between 6 to 17 receive a. Before 2021 the credit was worth up to 2000 per eligible child.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. Families who sign up may receive half of their total 2021 Child Tax Credit on Dec. The CTC was changed in two key ways in 2021 as part of the Democrats American Rescue Plan.

To reconcile advance payments on your 2021 return. Specifically the Child Tax Credit was revised in the following ways for 2021.

Child Tax Credit Updates Why Are Some Ctc Payments Lower In October Marca

Families Could Get 1 800 Per Child Tax Credit But Must Register Now

How Can I Claim My Remaining Child Tax Credit Ctc Or Missing Dependent Stimulus Payment In 2022 Irs Refund Payment Delays

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

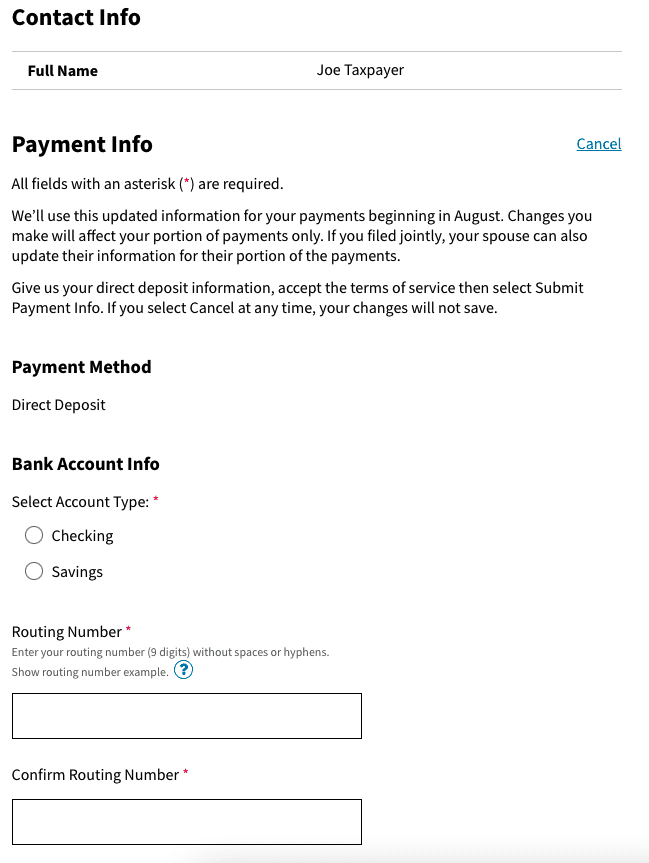

2021 Child Tax Credit Steps To Take To Receive Or Manage

2021 Child Tax Credit Steps To Take To Receive Or Manage

2021 Child Tax Credit Steps To Take To Receive Or Manage

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

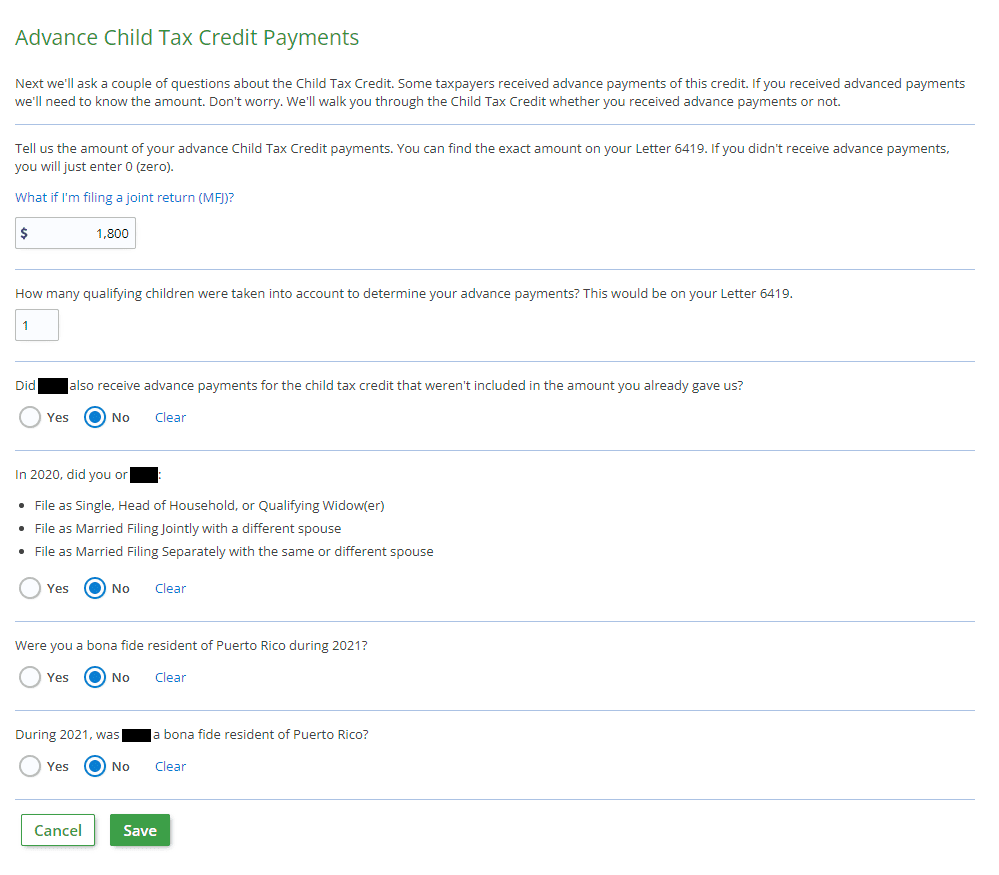

2021 Child Tax Credit Advance Payments Claim Advctc

2021 Child Tax Credit Steps To Take To Receive Or Manage

2021 Child Tax Credit Steps To Take To Receive Or Manage

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

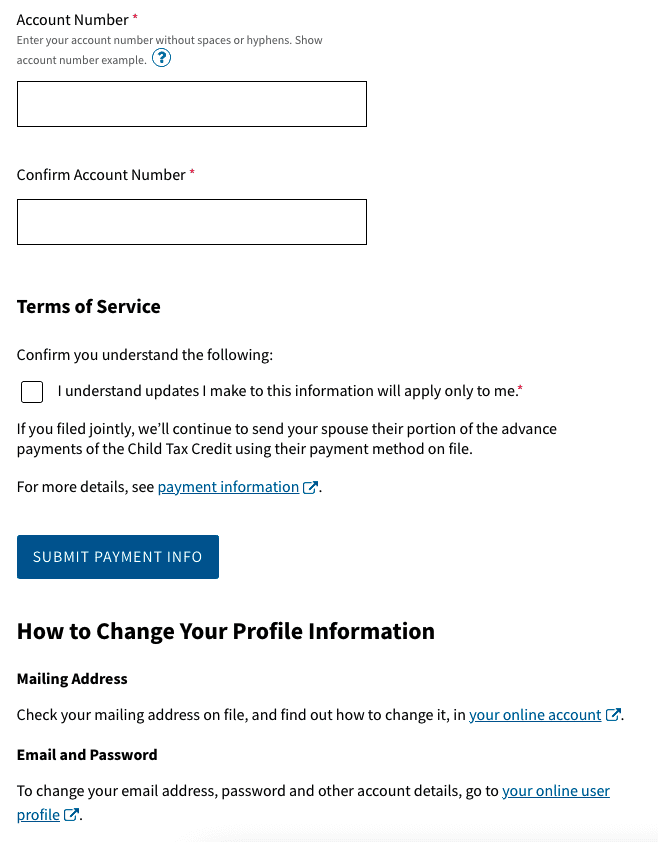

Issues With Child Tax Credit Direct Deposit How To Fix It By Aug 2 Cnet

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet